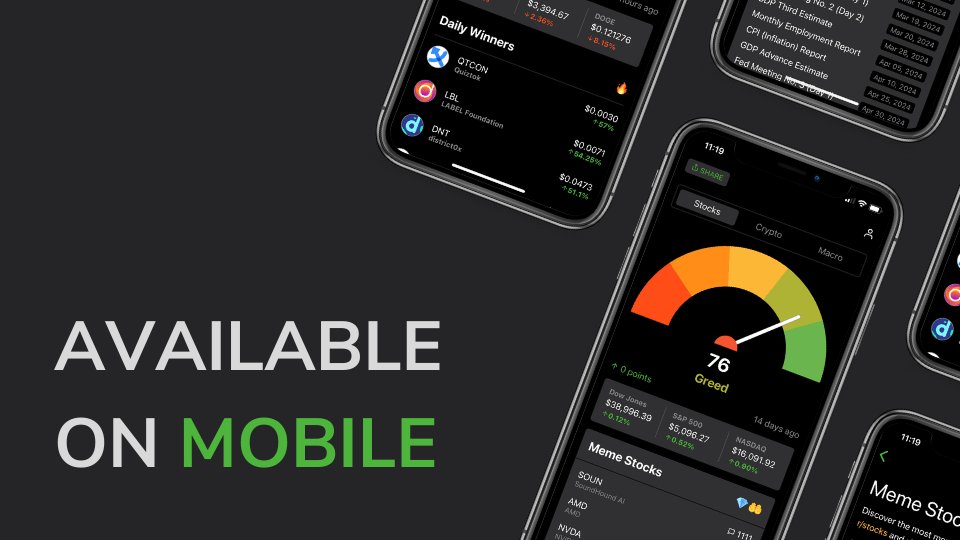

Top 100 Most Popular Meme Stocks Today

Discover today's Top 100 Most Popular Meme Stocks, based on number of mentions on r/stocks and r/wallstreetbets. Our list refreshes every 5 minutes, ensuring you have the most current data straight from Reddit's community. Never miss an opportunity to be ahead of the curve.

Over the last 24 hours, these top 100 meme stocks from Reddit have seen 1279 mentions and 7651 upvotes, marking a uptrend from the previous day.

What is a Meme Stock?

A meme stock is a stock that goes viral online, often hyped on social media and forums, leading to rapid price increases. It's driven more by investor enthusiasm than the company's fundamentals. This phenomenon can cause volatile trading and risky investments, with GameStop's 2021 surge being a prime example.

The Psychology Behind Investing in Meme Stocks

The psychology behind investing in meme stocks revolves around the collective behavior and emotional decision-making of investors influenced by social media hype and a desire to be part of a community movement. It often involves a blend of FOMO (fear of missing out), the thrill of participating in a perceived underdog victory against institutional investors, and the allure of quick profits. This psychological phenomenon can lead investors to make decisions based on sentiment and peer influence rather than traditional financial analysis, potentially increasing the risk of financial loss.

The Role of Reddit in the Meme Stock Phenomenon

The role of Reddit in the meme stock phenomenon is pivotal, serving as the primary platform where retail investors gather, share information, and rally support for certain stocks. Subreddits like WallStreetBets have become forums for discussing investment strategies, celebrating gains, and coordinating buying efforts to influence stock prices. This collective action can lead to significant market movements, showcasing the power of social media to mobilize individual investors and challenge traditional market dynamics. Reddit's influence highlights a shift in how investment decisions can be made and the impact of community-driven strategies on the financial markets.

How Meme Stocks Have Affected Traditional Investing Principles

Meme stocks have challenged traditional investing principles by emphasizing market sentiment and collective action over fundamental analysis. This shift has introduced increased volatility and unpredictability into the stock market, as prices of meme stocks can surge or plummet based on social media trends rather than company performance. This phenomenon has forced traditional investors and analysts to reconsider the role of social media in market dynamics and the importance of understanding investor behavior. As a result, some traditional investment strategies are being adapted to account for the potential impact of viral trends on stock prices, signaling a significant evolution in how market value is assessed.